FORTUNE magazine ran an article, “Look who pays for the bailout” in its November 10 issue about how high earners, not rich yet (HENRY) must starve themselves of luxuries to become wealthy. The writers of the article believe that it’s not fair that HENRYs pay a high amount of tax because they are hard working individuals who aren’t even rich yet. They conclude: “The dream [of being rich] still lives for the HENRYs, but it’s elusive. It’s a dream that enriches us all, and that America would do well to nurture.”

Oh, come on!

I can’t believe people are making US$500,000 a year and complaining. These HENRYs can choose not to put almost US$50,000 a year into retirement. Others can’t. It’s a matter of choice and everything depends on your reference point.

As one forummer puts it:

I almost wept reading about those poor, targeted HENRYs in our country. It’s GOT to be pretty tough for them to make ends meet, what with all the private school tuition and socking away a mere US$4,000 per month in their retirement accounts on top of the nearly US$1,000 per month children’s college fund.

Just goes to show that the only people more preoccupied with money than the poor are the rich.

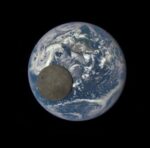

If you think you are unhappy, look at them.

If you think your salary is low, how about her?

Related post:

High-flying beggars

Technorati Tags: HENRYs Fortune whining high earners luxuries tax retirement

NEW YORK (CNN/Money) – Poverty and hunger are problems that many Americans relegate to the Third World. But the steady growth of poverty has left millions of American families afraid they won’t have enough money to put food on the table.

According to the most recent Census Bureau statistics, nearly 36 million Americans lived in poverty in 2003, an increase of 1.3 million from 2002. And since 2000, 4.4 million more people in this country are living in poverty. The Census Bureau defines poverty as an individual earning $9,393 or less and $14,680 or less for a family of three.

And American families are faring worse than they have in years. Last year 7.6 million American families — or 10 percent of all families — lived in poverty, a big jump from 2000.

But these figures don’t complete the story.

Jared Bernstein, a labor economist with the Economic Policy Institute, a liberal think tank, said the growth in the number of poor should give us pause, but even more troubling is the growing disparity in America between who is rich and who is poor.

In the last few decades, pay for wealthier Americans has risen dramatically — fueled by growth in salaries, bonuses, stock options and other compensation, Bernstein said. But wages for millions of lower-wage workers have dwindled. Many have lost their jobs altogether.

This “wedge” has prevented the benefits of economic growth from being spread equally. In addition, the current economic recovery is the weakest since World War II in terms of job growth.

Traditionally, the United States has used economic growth and job creation to reduce poverty, but in today’s world that’s only meaningful to the extent that wage inequality is reduced, Bernstein said.

“The U.S. economy has experienced three years of recovery, yet poverty has continued to go up,” he said.

In fact, the latest numbers show that nearly 6 percent of all working Americans lived in poverty last year — a level that’s remained stubbornly high.

Also surprising: the rise in the number of married couples in poverty, since they are traditionally the most resilient demographic. In 2003, 3.1 million married couples lived in poverty, with 53 percent of poor families headed by a married couple, a dramatic increase from 2001 when 2.8 million married couples were poor.

William Dickens, an economist with the Brookings Institution, agrees that the gap between rich and poor is widening, but he says, “in the last 30 years, it has taken robust economic growth for wage gains at the bottom of the income bracket. In general, this has not been a roaring recovery.”

But Dickens says even in this period of weak economic recovery, workers can get by, if they are educated and flexible enough. More education translates to better pay, according to Dickens.

But as skilled American workers compete with a growing number of well educated and cheaper overseas workers, the wage gap in the U.S. will most likely continue to grow, says Kent Hughes, an economist with the Woodrow Wilson Center in Washington DC. Hughes believes that the already limber American worker is going to have to become even more flexible as jobs traditionally reserved for white-collar American workers, such as computer programming, are being done more cheaply abroad.

Hunger

Fear and hunger walk hand in hand with poverty, and last year 12.6 million American households — 11.2 percent of all American homes — were afraid they might not be able to put enough food on the table, according to the Census Bureau. That’s up more than 1.6 million households from the year 2000.

How are these families coping? They eat less varied meals, visit shelters and get food assistance from food banks and emergency kitchens. Of these families, 3.9 million said that one or more members of the family actually went hungry last year — an 18.2 percent increase from 2000.

A recent report by the outplacement firm Challenger Gray and Christmas found that many food banks are in “crisis mode.” In Ohio, for example, the Ohio Food Bank has seen the number of people requiring assistance jump 17 to 20 percent this year, “with a significant increase in the number of working poor.”

Millions of working Americans are struggling to find adequate food, health care and housing for their families. Unable to earn a living wage, many have resorted to food banks and community centers for help. But according to the Challenger report, many of those institutions say that making the increased demand even worse is the fact that “donations and government funding are at all-time lows.”